Why SMART Margin Financing?

Facility Limit

And brokerage from as low as RM5.

Competitive interest rates

Cutting-edge charting tools for both beginner and experienced investors.

High margin of financing

Margin of financing: Up to

Daily rest basis interest calculation

And brokerage from as low as RM5.

SMART and convenient trading facilities

SMART Revolving Facility Trading limit up to: 2.0X of fixed deposit/ cash amount & 1.0X of shares / & SMART Revolving facility is subject to yearly review

High margin of financing

Margin of financing: Up to

Fee Schedule

Up to BR+2 20% p.a. and current BR at 3.6% p.a.

SMART Termsheet

| Features | SMART |

| Margin of Financing | Up to 50% |

| Margin Call | >60%/3 days grace period |

| Interest Rate | 6.00% to 6.50% p.a. (subject to approval) |

| Rollover Fee | NA |

| Tenure | Subject to Annual Review at the discretion of the Bank |

| Others | Cash withdrawal |

Why invest Malaysian stocks

with Webull?

Zero platform fee Zero platform fee

And brokerage from as low as RM5.

Innovative

Cutting-edge charting tools for both beginner and experienced investors.

Information is power

Gain access to a library of financial contents.

Regulation

We are licensed and regulated by the Securities Commission of Malaysia.

Discretionary Financing (DF)

Spot on investment

opportunities

Discretionary Financing (DF)

What and How DF Works? DF allows a Client to effect settlement of the Client’s outstanding purchase position in relation to a contract between the third (3rd) market day following the contract date (T+3) and seventh (7th) market day following the contract date (T+7), except for Direct Business Transaction (“DBT”) contracts.

Why Discretionary Financing (DF)?

Extension of Holding Power

Subject to approval, facility limit varies from case to case.Extend your stock holding power up to T+7 with hassle-free settlement for your due purchase transactions.

Extra Flexibility

Enjoy greater flexibility to manage your portfolio. DF allows client to settle the outstanding purchase position in relation to a contract between T+3 till T+7 (no later than 12.30pm on the T+7).

Save on Brokerage Fees

Fees incurred on DF are lower than brokerage fees that is paid to roll over another purchase contract.

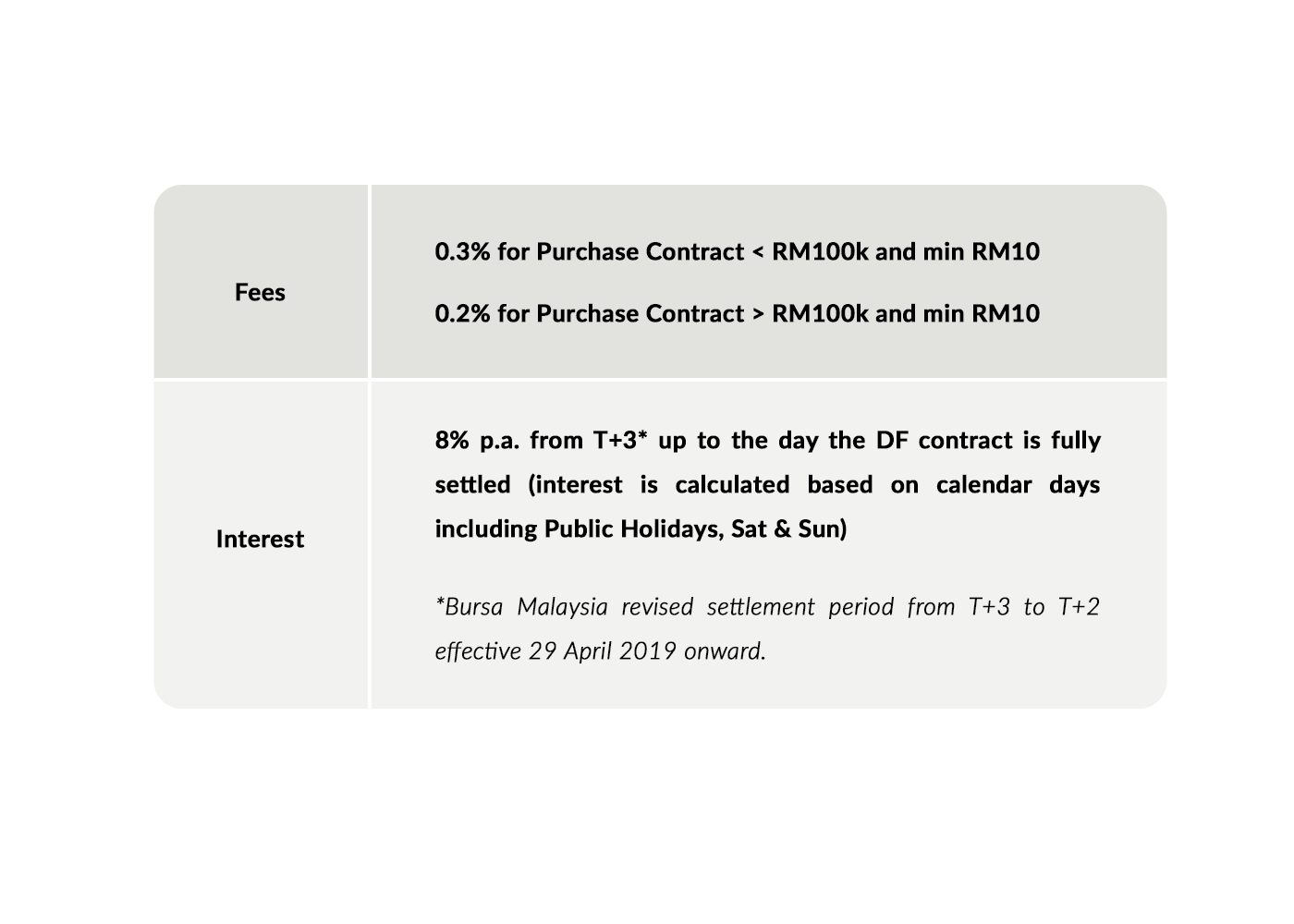

DF Fees & Schedule

| Fees | 0.3% for Purchase Contract < RM100k and min RM100.2% for Purchase Contract > RM100k and min RM10 |

| Margin of Financing | 8% p.a. from T+3* up to the day the DF contract is fully settled (interest is calculated based on calendar days including Public Holidays, Sat & Sun)*Bursa Malaysia revised settlement period from T+3 to T+2 effective 29 April 2019 onward. |

Example:

DF Fee @ 0.2% (RM100,001 x 0.2%)

| Purchase Value (PV) | RM100,001 |

| DF Fee @ 0.2% (RM100,001 x 0.2%) | RM200 |

| DF interest @ 8% is calculated based on calendar days and will be charged from T+3 up to the date of payment by client or to the due date of the sale of shares for contra.If DF contract is settled by T+7 (cross-over weekends) DF Interest = (RM100,001 x 8% x (7/365 days))If DF contract is closed by way of contra via sale of sharesDF Interest = (RM100,001 x 8% x (9/365 days)) | Example Text |

| Total DF Cost | RM353.43 |

Eligibilty

1. DF available to Retail Client only for the purpose of trading on the stock market of Bursa Securities.

*Terms and condition apply. For more information, please contact your dealer’s representative / remisier or visit our branch.

DF Fees & Schedule

Up to BR+2 20% p.a. and current BR at 3.6% p.a.