Foreign Investing Services (FIS)

Diversify your investment portfolio in various Foreign Stock Exchanges with the convenience of single trading limit and login ID for up to 13 exchanges, namely Hong Kong Stock Exchange (HKSE), Singapore Exchange (SGX), National Association of Securities Dealers Automated Quotations (NASDAQ), New York Stock Exchange (NYSE), Australian Securities Exchange (ASX), London Stock Exchange (LSE), Taiwan Stock Exchange (TWSE), Indonesia Stock Exchange (IDX), Tokyo Stock Exchange (TSE), Stock Exchange of Thailand (SET), Toronto Stock Exchange (TSX), Korea Exchange (KRX), and Philippine Stock Exchange (PSE).

Why Trade FIS?

Convenience

Trade FTSE Bursa Malaysia Kuala Lumpur Composite Index (FBM KLCI) Futures Contract which exposes traders to the underlying FBM KLCI constituents.

Easy Settlement

Trade the Crude Palm Oil Futures Contract which exposes traders to the global price benchmark for the Crude Palm Oil Market.

Reliable custodial service

All foreign securities you have bought and paid is kept in trust. Rest assured, all corporate entitlements are monitored and administered by us.

Proactive updates

Monthly consolidated custody statement of all foreign securities held.

Why trade FIS with AmEquities?

Educational Video

Why Trade Futures with Webull?

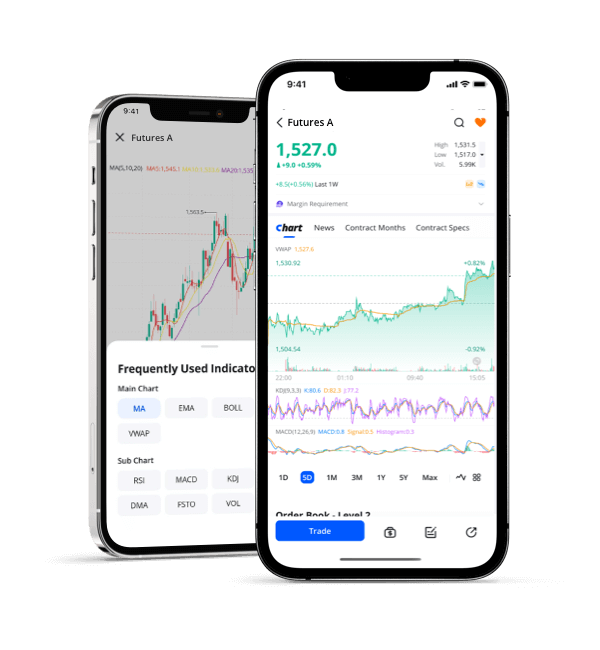

Advanced Data and Charting Tools

Take advantage of high-level tools including

| Month/Year | Educational Video |

| November 2022 | Discover The Gems In Singapore Stock Market |

| July 2023 | Second Half Economic Outlook + Deep Dive on Singapore Market Outlook |

| September 2023 | Thailand Market Outlook |

| February 2023 | Unlocking the Singapore Market Potential for 2023 |

| April 2023 | MY Market Insight + SG Growth Investment |

Educational Video

| Month/Year | Educational Video |

| November 2022 | Discover The Gems In Singapore Stock Market |

| July 2023 | Second Half Economic Outlook + Deep Dive on Singapore Market Outlook |

| September 2023 | Thailand Market Outlook |

| February 2023 | Unlocking the Singapore Market Potential for 2023 |

| April 2023 | MY Market Insight + SG Growth Investment |

Education Talk of the Month

| Month/Year | Educational Video |

| November 2022 | ETSG Singapore Stock Selector Tool |

| July 2023 | 5 key reasons why you should start to explore futures trading |

| September 2023 | Overview of Malaysia and Singapore REITS – Part 1 |

Education Talk of the Month

| Month/Year | Educational Video |

| November 2022 | ETSG Singapore Stock Selector Tool |

| July 2023 | 5 key reasons why you should start to explore futures trading |

| September 2023 |

Overview of Malaysia and Singapore REITS – Part 1 Overview of Malaysia and Singapore REITS – Part 2 |